Latest Company & Industry News

What's coming for 2024

Posted by soles on November 20, 2023

2024 is just around the corner! Whether you own a car or a business there are changes in store and some opportunities to save!. Here's a preview:

- Florida Worker’s Compensation Rates will decrease by 14.9% - the largest in 50 years.

- Companies currently insured with PEO’s and those who lease their employees could benefit the most by exiting the arrangement and obtaining their own policy.

- Premiums be reduced by packaging all lines of commercial insurance, especially with Business Auto. By packaging General Liability, Equipment, Property, Worker’s Compensation, Business Auto & Umbrella with one carrier, premium savings can be obtained.

- Business Auto is experiencing the largest premium increasing amongst all commercial lines of coverage. We provide custom driver onboarding that includes defensive driving training, telematics installation and data review training to monitor driver activity and scoring drivers based on their vehicle acceleration, breaking, speed and use of safety measures such as seatbelts and turn signals.

- Driver training and safety awareness. Lower claims cost result in lower premiums

Understand your policy's hidden exclusions - DO NOT seek lower premiums without a thorough understanding of your coverage.

Is your business at a crossroads

Posted by soles on June 5, 2023

Is your business at a crossroads with regards to contractual Payment & Performance Bonds? Does your insurance appear to be powerless in getting these bonds approved and issued for your company? Do not let these multi-million dollar opportunities pass your business by due to lack of knowledge from your insurance agent regarding commercial bonds. Having your company bonded will elevate your business to the highest levels within your industry of trade. We can shepherd your company through applications process and avoid the need to provide private financial information.

The Right Agency Partner

Posted by soles on July 25, 2022

Do you consider your current plan to be exceptional in these areas of service, dedication and price? Does your business have additional service needs or lines of coverage that continue to increase in premium cost? Have you considered other options? If you are curious about what is available to you, we are confident that it all starts with the right agency partner.

Consider the following decision points, which can help you organize and consider issues most important to you.

- Worker’s Compensation: It is more than just payrolls and rates. Our carriers can apply additional premium credit factors and Dividend Reward Plans that will reduce your annual premiums on average of 20%

- General Liability & Business Auto: We have a specialized Artisan Contractor program for HVAC, Plumbing & Electrical Contractors that will be among the best offerings available. Packing multiple lines will result in reduced premiums

- Certificates of Insurance: Our agency’s dedicated staff will be able to issue one certificate of insurance to include all lines of coverage. You will never have to contact multiple sources or experience long wait times for certificates.

- Payroll & Human Resources: Payroll Services will provide all tax filings, W-2s, Quarterly Tax Reports, Worker’s Compensation Insurance Pay-As-You-Go Administration, and handling of annual audits.

We hope you find this information insightful. I would personally be very interested in finding time to discuss your questions or concerns or other ways we will be able to increase your company’s bottom line.

Helping America Get Back to Work

Posted by soles on July 23, 2021

Helping America Get Back to Work.

America’s small business owners face unprecedented challenges in the form of inflation, rising employee wages and labor shortages. Our team is dedicated to helping businesses avoid the rising cost of insurance premium and Human Resource fees. From Worker’s Compensation to General Liability to Business Auto, do accept your increased insurance renewal without speaking with one of our dedicated team members. We have the ability to negotiate with Insurance Companies to allow to obtain the premium relief your business need to excel and get back to work.

What is a CTR Contract? Consent To Rate Contract

Posted by soles on November 25, 2020

Does your company’s worker’s compensation policy currently contain a CTR Contract - Consent To Rate Contract. If not, please be sure to have our team review your proposed renewals to confirm that your renewal does not contain this surcharge.

The CTR is a contract that your insurance company requires you to sign and consent to surcharged rates as a contingency to provide coverage or to offer a renewal for policy coverage. If your company is facing this situation in regards to your worker’s compensation insurance renewal, we urge to contact our offices and we will provide you with the best course of action for your renewal and help your company to avoid this surcharge.

Cheaper does not always cost less...

Posted by soles on July 17, 2020

Cheaper does not always COST LESS…

Discover quality, ethics, relationships and product knowledge that will serve as your most efficient cost prevention asset. Knowledge is Power and our team of highly experienced professionals will proactively guide you through your insurance needs. We will help you understand your policy EXCLUSIONS and provide with the proper coverage to avoid these pitfalls.

Covid-19 - Worker’s Compensation Update

Posted by soles on May 22, 2020

The state of Florida has approved NCCI’s B-1441 Item Filing. The filing addresses wage payments made to paid furloughed employees during a temporary layoff or an involuntary leave not working as a result of federal, state, and/or local emergency orders, laws, or regulations issued due to the COVID-19 pandemic.

These particular wage payments will be excluded from premium and experience rating calculations, providing the employer maintains separate, accurate, and verifiable records.

If separate records are not maintained, this payroll will be assigned to the classification applicable to the employee’s normal work performed prior to the issuance of any emergency orders, laws, or regulations related to the COVID-19 pandemic. Any payments from appropriated funds or loans authorized by any law or regulation, or public governmental entity used by an employer specifically to retain or hire working employees are still included as payroll for the calculation of premium and experience rating.

The revisions within the filing are effective on and after March 1, 2020 for new and renewal policies, and also apply to the unexpired portion of any policy in force as of 3/1/20. Code 0012 has been assigned to identify these payments for non-working employees.

Looking to be an Amazon Delivery Partner?

Posted by soles on May 8, 2020

Worker’s Compensation Insurance for Amazon Delivery Service Partners. Are you thinking of opening your own delivery service business partnered with Amazon? This is great business plan that is vital to the changing market place. If so, we can help your business make the crucial step in obtaining viable worker’s compensation coverage that will allow you to start working! Contact our team of professionals today to get started.

SBA PPP Loans Restart Today

Posted by soles on April 27, 2020

The SBA will reopen the PPP (Payroll Protection Program) today for a round 2 of loans to help fight the economic difficulties of the Corona Virus. To apply go to SBA.gov starting at 10:30 am EST. Remember as well, if you're looking to streamline your business we can help to make sure your policies fit your business and your price points are the most affordable available. We can also address payroll needs to help streamline and cut overhead costs. Reach out to us anytime at 863-438-2710.

#sba #ppp #cornavirus #smallbusiness

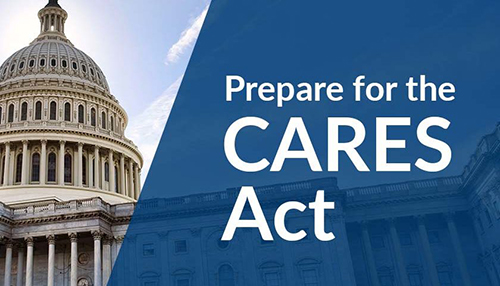

Prepare for the CARES Act

Posted by soles on April 3, 2020

Effective Friday, April 3, 2020, small businesses and sole proprietors can apply. Self-employed and independent contractors can apply starting Friday, April 10th. Once they are finalized, applications will be available from your local banker, https://www.sba.gov/document/sba-form--paycheck-protection-program-ppp-sample-application-form

Businesses can borrow 2.5 times what their average monthly payroll was during the period 2/15/19 to 2/15/20. To determine your monthly payroll amount, you can include salary, wages (including cash tips), employee group health care insurance premiums, retirement contributions, and medical/sick leave. Example: If your annual payroll cost (adding in all these items) for the period 2/15/19 – 2/15/20 was $500,000, your average monthly payroll cost is $41,667. You can borrow 2.5 times your average monthly payroll cost, for a total loan amount of $104,168.

Because the loans are intended to help businesses keep paying their employees, the expectation is that a business will use at least 75% of the loan proceeds on salary (including health insurance, retirement, and leave) and no more than 25% of the loan proceeds on the other approved items (rent, utilities, and interest on mortgages or other obligations). Any amount of the loan over 25% used for approved items other than salary will not be eligible for forgiveness.

Covid 19 Update

Posted by soles on March 31, 2020

The Covid-19 outbreak has brought about very obvious and painful financial hardships to peoples and businesses. Many of our contracted insurance carriers are offering payment extensions to policyholders until April 30,2020. Please do not hesitate to contact our offices to review your options for this relief.

OSHA 300 Annual Report

Posted by soles on February 13, 2020

Is your Insurance Agency assisting your business with your OSHA 300 Annual Report? If you have 20 employees or more, OSHA requires many employers to provide an annual report of work-related injuries or illnesses. The annual deadline to file this report electronically is March 2, 2020. If you feel that your company has been neglected of this service, do not hesitate to contact our team of professionals to guide you through this process and avoid future penalties.

Do You Award Per Diem to Your Employees...

Posted by soles on January 27, 2020

If your employees travel extensively in the course of their job requirements and are awarded Per Diem Pay it is critical that this reimbursement is recorded correctly within your payroll records to insure your company is not being charged worker’s compensation insurance and additional payroll taxes for this employee reimbursement. Too many times, employers commit the costly error of recording Per Diem Pay as income to their employees. Learn how to avoid this crucial error by contacting Van Soles today!

Restaurant Owners Need to KNOW This...

Posted by soles on January 9, 2020

Restaurant Owners, we understand that your industry margins are very critical and our tailored restaurant program is designed to reduce your worker’s compensation cost and streamline your payroll needs. Our carriers are endorsed by the Florida Restaurant & Lodging Association. Contact us today to allow our team to teach you everything from payroll taxes, FICA Tip Credit, Worker’s Compensation to securing your business liabilities and property.

Fraud Awareness

Posted by soles on December 9, 2019

Soles Insurance Group Fraud Awareness Tip of the Week:

Many forms of insurance are centered around bodily injury and when your claim involves a medical provider, it is imperative that your Insurance Agent is practicing Medical Bill Review on your behalf. Medical Providers from several states have been caught and plead guilty to incorrect, overcharged and mischarged medical services and prescriptions. These blatant errors can have an extremely negative impact on worker’s compensation insurance premiums. Let our of Professionals audit your company’s claims history to identify and correct these potential premium driving errors.

Is your business currently obtaining worker’s compensation insurance?

Posted by soles on November 22, 2019

Is your business currently obtaining worker’s compensation insurance through a PEO or Employee Leasing Company? We can assist your business in navigating your options that will create a more cost effective program for both Worker’s Compensation Insurance and Payroll Services. Florida Worker’s Compensation rates are at all times lows and to avoid duplicate payments for state and federal payroll taxes, the fourth quarter is the most ideal time for your business to review the options for available. Our team of professionals can provide you with an transitional exit strategy that will bridge your business into your own worker’s compensation policy and provide the same payroll services with a more cost-effective pricing scale for 2020.

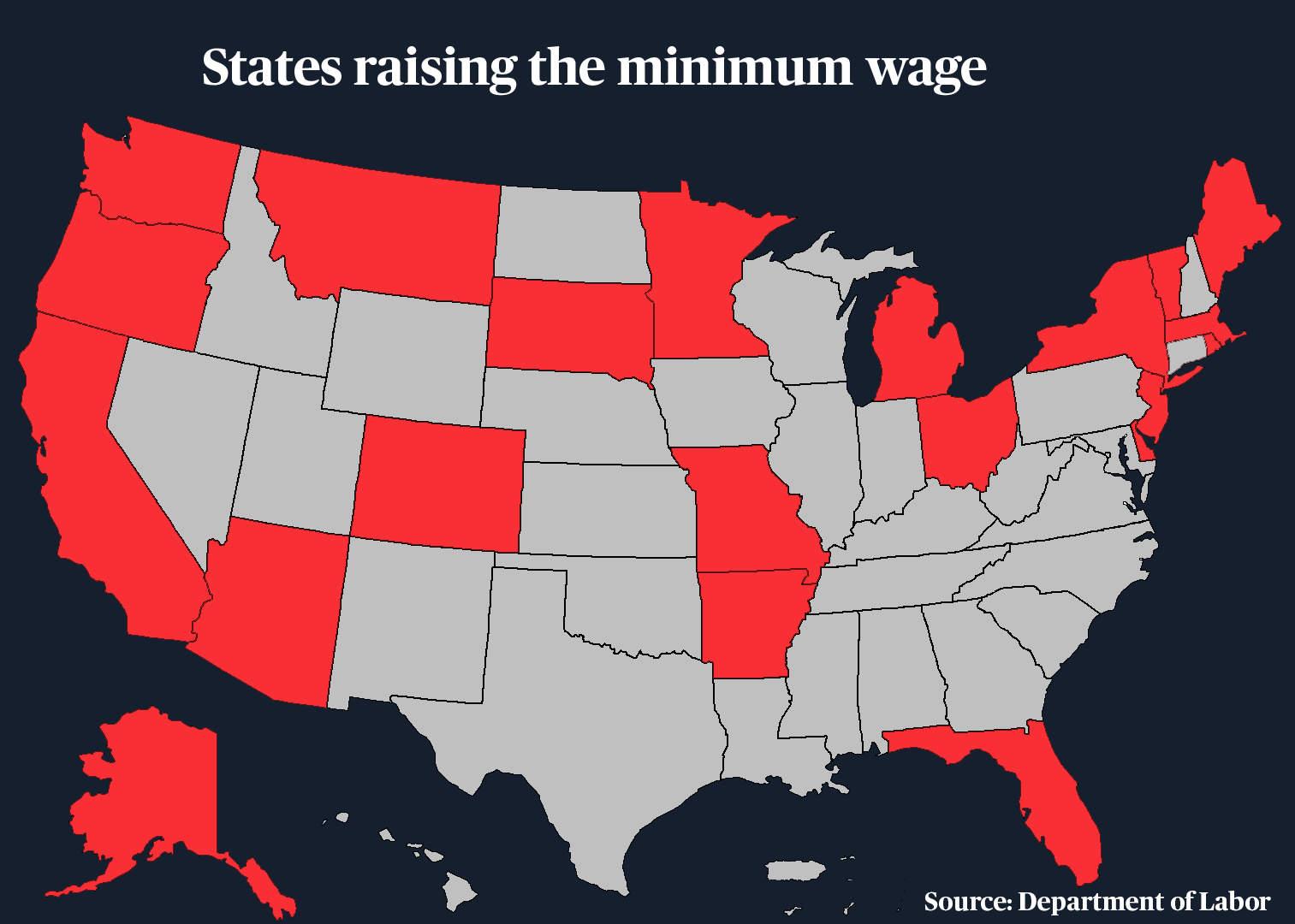

State Minimum Wage Increasing Again for 2020

Posted by soles on November 7, 2019

Effective January 1, 2020, the Florida minimum wage will increase 10¢ an hour, from $8.46 an hour to $8.56 an hour. The cash wage for tipped employees is also increasing 10¢, from $5.44 an hour to $5.54 an hour.

With this change to the Florida minimum wage, all Florida employers will be required to display a new minimum wage poster for 2020.

Form Revisions – Effective November 1, 2019

Posted by soles on October 28, 2019

Due to recent changes in Florida Statutes related to application requirements, revisions have been made to the following NCCI issued forms to be used for all new and renewal business effective November 1, 2019:

- · Florida Contracting Classification Premium Adjustment Program

- · Application for Drug-Free Workplace Premium Credit Program

- · Certification of Employer Workplace Safety Program Premium Credit

Contact our team today to ensure that your policy credits are properly renewed with the correct applications.

1% Surcharge on All Workers’ Comp Policies in Florida Starts 1/1/20

Posted by admin on October 9, 2019

Under an order by the Florida Office of Insurance Regulation, all new and renewal workers’ comp policies issued in Florida during calendar year 2020 will have a 1% surcharge added to the policy premium. The policy surcharge is being levied by the Florida Workers’ Compensation Insurance Guarantee Association (“FWCIGA”), the statutory association which pays claims for policyholders whose workers’ comp carrier becomes insolvent. The 1% surcharge is primarily due to the claims associated with the 2017 insolvency of Guarantee Insurance Company.

To be prepared for this surcharge and obtain solutions to offset the cost, contact our team of professionals today.

Your worker's compensation insurance stat cards are being filed 2019

Posted by admin on March 7, 2019

Attention all July 1, 2019 policy holders! Your worker's compensation insurance stat cards are currently being filed for based on your current claims history from 2015 -2017 to comprise your 2019 experience mod. We urge you to address any open claims you may have. Please contact our offices for assistance in claims management to insure your 2019 experience mod will be published correctly in favor of your company instead of the insurance carrier!

Your worker's compensation insurance stat cards are being filed

Posted by admin on September 19, 2017

July 5, 2012 - Attention all January 1, 2013 policy holders! Your worker's compensation insurance stat cards are currently being filed for based on your current claims history from 2009-20011 to comprise your 2013 experience mod. We urge you to address any open claims you may have. Please contact our offices for assistance in claims management to insure your 2013 experience mod will be published correctly in favor of your company instead of the insurance carrier!

Notice of Workers' Compensation Exemption Law Change

Posted by admin on January 2, 2017

Florida Legislature passed and the Governor signed into law CS/HB 941, which amended Sections 440.02(9) and 440.05, Florida Statutes. Non-construction industry employers with four or more full-time or part-time employees must provide coverage for all employees. Effective July 1, 2013, the law changes to include Limited Liability Company (LLC) members as employees. LLC members will be included on their Workers' Compensation insurance policy; however, they may elect to be exempt by filing a Notice of Election to Be Exempt with the Division of Workers' Compensation (Division). The Division's Notice of Election to be Exempt web-based system is available for applicants to electronically apply for or renew their Certificate of Election to be Exempt. To access the system, go to the Division's website at www.MyFloridaCFO.com/WC and select the "Apply for an Exemption" icon. If you have any questions, please contact the Division's Customer Service Representatives at (850) 413-1609, or you may participate in a Division-sponsored webinar. Several webinars are scheduled during February 2013. Please visit their website or email BocSeminars@MyFloridaCFO.com for more information. Insured’s can begin filing exemptions on April 1, 2013 to be effective July 1, 2013.

4:19 pm